By Ingrid Luden, Techcrunch

The onward march for Android and Apple continues apace, and leaves a big question mark for how other platforms can hope to compete, at least in the U.S. market: New figures out fromJumptap indicate that in the month of January, the two combined made up 91 percent of all smartphone traffic on its U.S. mobile ad network — representing a new high for the two most-dominant mobile phone platforms.

But while Apple has seen a huge jump in smartphone users following the launch of the iPhone 4S last year, Jumptap’s figures indicate that in tablets it has a strong competitor in the form of the Kindle Fire, which now accounts for 33 percent of all tablet traffic on the network.

While these numbers do not exactly speak to how many Kindle Fire devices there are in use compared to iPads (we have a bit more on that subject here), it does point to the fact that people are using their Amazon devices for a whole lot of ad-based services.

Jumptap’s numbers indicate that while Apple (at 32.2 percent) and Google (at 58.8 percent) are dominating across its U.S. ad network of 95 million monthly users, the weak appear to be getting weaker: RIM’s BlackBerry platform is at a “new low” of 6.7 percent share of impressions, while Symbian accounted for 1.4 percent of impressions, and Windows Mobile for even less: 0.5 percent.

Jumptap’s prediction is that despite gains that Microsoft may make as a result of Nokia’s new line of Windows Phones, collectively the bottom three will not have more than 10 percent of impressions at any point this year. Still, that is actually leaving room for some growth…

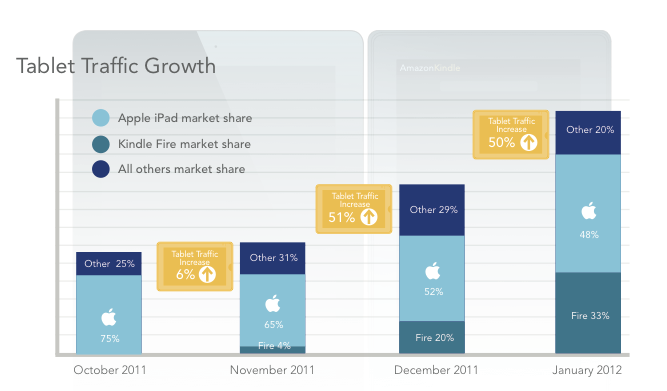

In tablets, Amazon is proving to be a strong competitor, at least in the area of usage. In January, it accounted for 33 percent of all tablet traffic, and as you can see from the table below, that share has risen quickly over the last three months, outpacing even the growth of tablet traffic itself. Apple’s share, meanwhile, is at its lowest in four months, at 48 percent. Ditto the collective force of all of the other tablet makers.

But while Apple has seen a huge jump in smartphone users following the launch of the iPhone 4S last year, Jumptap’s figures indicate that in tablets it has a strong competitor in the form of the Kindle Fire, which now accounts for 33 percent of all tablet traffic on the network.

While these numbers do not exactly speak to how many Kindle Fire devices there are in use compared to iPads (we have a bit more on that subject here), it does point to the fact that people are using their Amazon devices for a whole lot of ad-based services.

Jumptap’s numbers indicate that while Apple (at 32.2 percent) and Google (at 58.8 percent) are dominating across its U.S. ad network of 95 million monthly users, the weak appear to be getting weaker: RIM’s BlackBerry platform is at a “new low” of 6.7 percent share of impressions, while Symbian accounted for 1.4 percent of impressions, and Windows Mobile for even less: 0.5 percent.

Jumptap’s prediction is that despite gains that Microsoft may make as a result of Nokia’s new line of Windows Phones, collectively the bottom three will not have more than 10 percent of impressions at any point this year. Still, that is actually leaving room for some growth…

In tablets, Amazon is proving to be a strong competitor, at least in the area of usage. In January, it accounted for 33 percent of all tablet traffic, and as you can see from the table below, that share has risen quickly over the last three months, outpacing even the growth of tablet traffic itself. Apple’s share, meanwhile, is at its lowest in four months, at 48 percent. Ditto the collective force of all of the other tablet makers.

This is a key point, because it indicates that those who are buying the Kindle Fire are also buying into the whole service-led proposition behind it: content is something that Apple has, up to now, been able to say that it does better than any other Android tablet maker, but Amazon’s mix of its appstore apps, plus offerings of streamed content and more besides appears to be giving that idea a run for its money. That also indicates to developers that this is a potentially strong platform to develop for.

What remains to be seen is whether Apple has another “new launch” effect in the coming months, as a result of its news on Wednesday. It’s expected that Apple will reveal a new iPad and in the process could see the same effect on the tablet market that the introduction of the iPhone 4S had on its market share in smartphones last quarter — when, by most accounts, its share jumped quite significantly compared to those of other device makers.

What remains to be seen is whether Apple has another “new launch” effect in the coming months, as a result of its news on Wednesday. It’s expected that Apple will reveal a new iPad and in the process could see the same effect on the tablet market that the introduction of the iPhone 4S had on its market share in smartphones last quarter — when, by most accounts, its share jumped quite significantly compared to those of other device makers.

RSS Feed

RSS Feed